kinomorsik.online Market

Market

Auto Loan Interest Rate For 800 Credit Score

Average Auto Loan Rates by Credit Score ; Deep subprime, , %, % ; Subprime, , %, %. Simple. Fast. Convenient. ; Auto Loan Rates · AUTO LOANS · 36 months · as low as %, $ ; Home Equity Loans · HOME EQUITY LOANS · 60 months · as low as %. Average Interest Rates · – % interest rate (on average) · – % interest rate (on average) · and below: % – % (on average). The best interest rate for you will depend on your credit and the type of car you purchase. With rates starting as low as % APR, we are committed to. Possible % rate discount is available, depending on your credit score, for loans with a loan-to-value ratio under 80%. Total maximum rate discount is %. What is a Good Interest Rate? · – credit score: % interest rate (on average) · – credit score: % interest rate (on average) · and below. 1. Determine your budget · 2. Check your credit · 3. Do your research · 4. Apply for preapproval and shop for your car · 5. Compare car loan quotes · 6. Read the. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. – %; – %; and below: % to %. How Can I Lower My Car Loan Interest Rate? Average Auto Loan Rates by Credit Score ; Deep subprime, , %, % ; Subprime, , %, %. Simple. Fast. Convenient. ; Auto Loan Rates · AUTO LOANS · 36 months · as low as %, $ ; Home Equity Loans · HOME EQUITY LOANS · 60 months · as low as %. Average Interest Rates · – % interest rate (on average) · – % interest rate (on average) · and below: % – % (on average). The best interest rate for you will depend on your credit and the type of car you purchase. With rates starting as low as % APR, we are committed to. Possible % rate discount is available, depending on your credit score, for loans with a loan-to-value ratio under 80%. Total maximum rate discount is %. What is a Good Interest Rate? · – credit score: % interest rate (on average) · – credit score: % interest rate (on average) · and below. 1. Determine your budget · 2. Check your credit · 3. Do your research · 4. Apply for preapproval and shop for your car · 5. Compare car loan quotes · 6. Read the. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. – %; – %; and below: % to %. How Can I Lower My Car Loan Interest Rate?

As of , the average interest rate for car loans was percent for new cars and percent for used cars.

New Vehicle ; Primary borrower credit score, +, ; Max Term, APR ; 84, %, % ; 72, %, %. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans · 4 Year Auto Loans · 5 Year Auto Loans · 6 Year Auto Loans. Improve your credit score and potentially lower your rates. Auto Loan Calculators. Explore how much you can afford and what your payments might be. Rates · Money Market Accounts · Certificates & IRA · Checking · Savings · Business Deposit Accounts · Credit Cards · Personal Loans · Vehicle Loans. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount; No application fees; Terms up to six years²; Onsite financing—tell the. New Auto/Motorcycle Loan: $ per month per $1, borrowed at % APR for 60 months. New RV/Personal Watercraft: $ per month per $1, borrowed at. Auto loan rates as low as % APR for used vehicles with a maximum age of 10 years with less than , miles. Income subject to verification. Must use auto. With an credit score, you are considered to have excellent creditworthiness, which puts you in a favorable position when applying for a car. , 0%, 3 Years, Calculate. , %, 4 Years, Calculate. , %, 5 Years It's the percentage of interest paid each year over the term of the loan. 6. New and Used Car APR Rates ; Average New Car Loan, Annual Percentage Rate, Average Used Car Loan ; , %, ; , %, ; , The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card. The average car loan rates are approximately % for new car loans and % for pre-owned vehicles. But this varies widely by your credit score. How Much Does it Cost? · Alliant's car buying service: % on new cars and % on used (with automatic payments discount). · Standard: % on new and %. Approximate loan payment and loan amount is $ on a $30, new auto loan with a month term at %. Rates and terms available for vehicles with up to. The size of your monthly payment depends on loan amount, loan term, and interest rate. Many factors affect your FICO Scores and the interest rates you may. – %; – %; and below: % to %. How Can I Lower My Car Loan Interest Rate? The interest rate you are offered will depend on both your current credit score and the size of the car loan. While interest rates can be negotiated. Auto loan rates as low as % APR for used vehicles with a maximum age of 10 years with less than , miles. Income subject to verification. Must use auto. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! Rates, terms, and conditions are subject to change. Auto loan payment example for illustrative purposes only: If you borrow $30, at a % annual percentage.

How Do I Know If My Bill Went To Collections

If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you. If you need to file an answer in your debt collection case you can find one in the forms section below. Bill of Sale - if the collection involves a debt buyer. I will check with each credit bureau to see if anything pops up. According to credit wise on my capital one app I don't have any collections so. How will I know if my debt has been sold to a debt purchaser? Your original creditors need to tell you when they sell your debt. You will also get a letter. If you do not have an attorney, the agency can contact other people only to find out where you live or work. The collector cannot tell these people that you owe. The quickest way to verify payment has been received is by contacting the collection agency directly. If I pay the Collection Agency directly, how long will it. Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your. So, after your debt has been transferred or sold, it will probably show up two times in your credit history. If the debt is sold again, another account is added. Check the “Account Information” or “Collections” section of the report. Check the section that “flags” new debt. The following types medical debt should not be. If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you. If you need to file an answer in your debt collection case you can find one in the forms section below. Bill of Sale - if the collection involves a debt buyer. I will check with each credit bureau to see if anything pops up. According to credit wise on my capital one app I don't have any collections so. How will I know if my debt has been sold to a debt purchaser? Your original creditors need to tell you when they sell your debt. You will also get a letter. If you do not have an attorney, the agency can contact other people only to find out where you live or work. The collector cannot tell these people that you owe. The quickest way to verify payment has been received is by contacting the collection agency directly. If I pay the Collection Agency directly, how long will it. Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your. So, after your debt has been transferred or sold, it will probably show up two times in your credit history. If the debt is sold again, another account is added. Check the “Account Information” or “Collections” section of the report. Check the section that “flags” new debt. The following types medical debt should not be.

Rules that collection agencies need to follow when they contact you to collect money that you owe.

Asking the Original Lender · Checking Your Credit Report · Checking Your Voicemail and Caller ID · Waiting for Them To Call You · Negotiating With a Collection. How do I know which outside collection agency has my debt? If your account becomes delinquent, it will be referred to a collection agency and collection fees. Unpaid taxes or violations owed to New York City are collected by the Department of Finance through letters, telephone calls, court actions, and other. If you do not have an attorney, the agency can contact other people only to find out where you live or work. The collector cannot tell these people that you owe. Learn how to handle collection agency calls and the rules they must follow when contacting you. Calling you without identifying who they are. Be cautious when talking to anyone who claims you owe a debt to them but will not provide you with their name and. If they can't find you, debt collectors may attempt to contact other people who know you, such as neighbors, relatives, friends and employers. When a collection. The IRS works with private collection agencies that work with taxpayers who have overdue tax bills. These agencies help taxpayers settle their tax debts. These let you know that your overdue tax account was assigned to a private collection agency. The private collection agency then sends their initial contact. If the agency is collecting on a bad check, it can add collection and legal fees as allowed by state law. Your attorney should be able to tell you how much the. Once you get the validation information (see What does the debt collector have to tell me about the debt), if you still don't recognize a debt, or don't think. Look at the collection letters they have sent you. The letters should have a return address and a phone number. If you have no letters try a. You may owe a debt, but you still have rights. And debt collectors have to obey the law. If You Owe Money Creditors don't want to bring in a debt collection. The agency may not contact you after that unless you are sent proof of the debt, such as a copy of the bill. A debt collector may not harass or abuse anyone. Lenders commonly send credit card accounts to a collection agency after days of non-payment. Either the original creditor or the collection agency may. You can, however, write a letter of goodwill and request that it be removed. Attach a copy of the bill, proof of payment, and the letter. FICO, a leading credit. Debts will not be submitted to DOR for collection if the debtor enters into a repayment agreement with the agency or is in active negotiations to resolve the. If you don't pay what you owe, you risk damage to both your credit scores and your credit reports for up to seven years. If you're contacted by a debt collector. If you have a bill in collections, it means that the original creditor assigned it or sold it to a debt collector. A debt collector must send you an initial letter within five days of contacting you to tell you the amount of the debt you owe, the name of the creditor to whom.

Does Hp Computer Come With Microsoft Office

Click here to find a great selection of MS Office Included Laptops from HP at QVC QVC's Privacy Statement does not apply to these third-party web sites. Collaborate for free with online versions of Microsoft Word, PowerPoint, Excel, and OneNote. Save documents, workbooks, and presentations online. Which means, you can download and install Microsoft Office on the new HP Laptop that you are planning to purchase without removing the license on your HP PC. If you purchase a new computer that does not come with pre-installed Microsoft Office, you can still install and use the software by purchasing a license or. Two USB-C ports let you charge on-the-go, transfer data fast, or create a desktop setup. Unlock your new superpower. Included in Surface Pro, Copilot in Windows. exclusive! HP 14” Intel 4GB RAM GB SSD Laptop w/Office & Mouse · · $ ; new! HP " Intel N 8GB RAM GB Storage Laptop Bundle w/Office Find the perfect Microsoft Office® suite for your HP® laptop, desktop, or printer at the HP® Store. Shop now for great deals on software. HP laptops typically do not come with Microsoft Office pre-installed. However, certain HP laptop models may offer a trial version of Microsoft Office for a. HP laptops do not come with Microsoft Office pre-installed. However, HP does offer various options for customers to access and use Microsoft Office. One popular. Click here to find a great selection of MS Office Included Laptops from HP at QVC QVC's Privacy Statement does not apply to these third-party web sites. Collaborate for free with online versions of Microsoft Word, PowerPoint, Excel, and OneNote. Save documents, workbooks, and presentations online. Which means, you can download and install Microsoft Office on the new HP Laptop that you are planning to purchase without removing the license on your HP PC. If you purchase a new computer that does not come with pre-installed Microsoft Office, you can still install and use the software by purchasing a license or. Two USB-C ports let you charge on-the-go, transfer data fast, or create a desktop setup. Unlock your new superpower. Included in Surface Pro, Copilot in Windows. exclusive! HP 14” Intel 4GB RAM GB SSD Laptop w/Office & Mouse · · $ ; new! HP " Intel N 8GB RAM GB Storage Laptop Bundle w/Office Find the perfect Microsoft Office® suite for your HP® laptop, desktop, or printer at the HP® Store. Shop now for great deals on software. HP laptops typically do not come with Microsoft Office pre-installed. However, certain HP laptop models may offer a trial version of Microsoft Office for a. HP laptops do not come with Microsoft Office pre-installed. However, HP does offer various options for customers to access and use Microsoft Office. One popular.

HP's head office in Japan, · Hewlett-Packard 's desktop, monitor and laptop · iPAQ h Pocket PC from · An HP camera with an SDIO interface. Office Personal included. Get full access to Microsoft Excel, Word, PowerPoint, OneNote, and Access with the included one-year subscription, and easily. HP 15" Touch Laptop Intel GB SSD HP Tech Support and MS $ QVC's Privacy Statement does not apply to these third-party web sites. © Get the OneNote app for free on your tablet, phone, and computer, so you can capture your ideas and to-do lists in one place wherever you are. HP "" Business Laptop, Free Microsoft Office with Lifetime License, Widescreen. HP Envy Move · Lenovo IdeaCentre AIO 3i · Dell Inspiron 24 All-in-One · Lenovo Yoga AIO 9i Gen 8 · HP Envy 34 All-in-One () · Apple iMac Inch (, M3). Did you know?Computers generally do not come with Microsoft Office. Microsoft Office comes in various forms including different products. The units come with Office Starter - it has some Office functionality but not like a full version. You can use this and it is not a trial program. HP Stream 14" Laptop 16GB RAM 64GB eMMC Intel Celeron N Microsoft Office All I have to do now is transfer files from other laptop, this should. MS Office is retail software and will not come bundled with a gaming laptop as it is unrelated to gaming. As stated elsewhere; buy a copy and. Check if Microsoft Office is pre-installed on your HP laptop. Click the Start button, type “Microsoft Office” in the search bar, and look for any Microsoft. Office only comes with a temporary license. Usually, they give you an Office subscription for a year. If you want to buy a permanent license. Yes, you can install Microsoft Word on your HP Laptop. Microsoft Word is part of the Microsoft Office suite, which is compatible with HP laptops. Follow these. Computers & Office; Microsoft Compatible: Laptops. Sponsored. Filter (1) hp windows laptop · asus rog strix g16 () gaming laptop, 16” nebula. Yes, most HP laptops come with a pre-installed version of Microsoft Office, which includes Microsoft Word. It is typically a trial version that provides limited. Shop for HP Laptop Microsoft Office at kinomorsik.online Save money. Live better. [27] This device does not contain user serviceable parts. Hard drive is only removable by an authorized technician following Microsoft provided instructions. [. From big brands including Microsoft, HP, Asus, Razer, Dell and more, uncover them all at JB Hi-Fi! Explore our Windows laptops online or in-store today. HP does offer models that come with a full version of Microsoft Office, but they are typically more expensive. Always check the software package included in. Product Details · Microsoft Personal (1-Year) is pre-installed. · The latest versions of: Word, Excel, PowerPoint, Outlook, OneNote, Publisher, and Access.

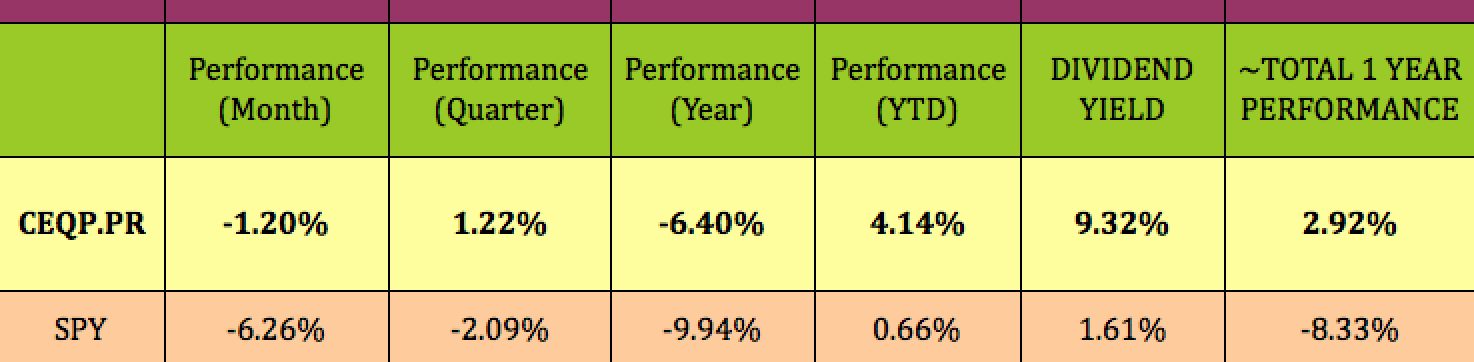

Ceqp Dividend

Dividends. Dividend history for stock CEQP-P (Crestwood Equity Partners LP) including historic stock price and split, spin-off and special dividends. kinomorsik.online Dividend History Chart. kinomorsik.online — News. Featured Slideshows. Top Ten Highest Yielding Preferred Stocks · Feel-Good Income: Socially Responsible. The table shows Crestwood Equity's dividend history, including amount per share, payout frequency, declaration, record, and payment dates. DKL CEQP KKR are going ex-dividend Wednesday, Wednesday, August 03, JTP GMLP CEQP are going ex-dividend tomorrow, Wednesday, May 04, JTP. CEQP Dividend Payout History. All Dividends Data. #, Declaration Date, Ex-Date, Pay Date, Amount, Yield. 1, Oct 11, , Oct 20, , Oct 31, , $ Full Crestwood Equity Partners LP Dividend History. Explore CEQP-P Dividend Yield, Historical Dividends, and Payout Ratio. Dividend History for Crestwood Equity Partners LP (CEQP). Ticker. | Expand Research on CEQP. Price: | Annualized Dividend: $ | Dividend Yield: %. Dividend history for stock CEQP (Crestwood Equity Partners LP) including historic stock price, dividend growth rate predictions based on history, payout ratio. CEQP is defunct since November 3, Summary · All · Analysis · Comments · News Top Quant Dividend Stocks · High Dividend Yield Stocks · Top Dividend. Dividends. Dividend history for stock CEQP-P (Crestwood Equity Partners LP) including historic stock price and split, spin-off and special dividends. kinomorsik.online Dividend History Chart. kinomorsik.online — News. Featured Slideshows. Top Ten Highest Yielding Preferred Stocks · Feel-Good Income: Socially Responsible. The table shows Crestwood Equity's dividend history, including amount per share, payout frequency, declaration, record, and payment dates. DKL CEQP KKR are going ex-dividend Wednesday, Wednesday, August 03, JTP GMLP CEQP are going ex-dividend tomorrow, Wednesday, May 04, JTP. CEQP Dividend Payout History. All Dividends Data. #, Declaration Date, Ex-Date, Pay Date, Amount, Yield. 1, Oct 11, , Oct 20, , Oct 31, , $ Full Crestwood Equity Partners LP Dividend History. Explore CEQP-P Dividend Yield, Historical Dividends, and Payout Ratio. Dividend History for Crestwood Equity Partners LP (CEQP). Ticker. | Expand Research on CEQP. Price: | Annualized Dividend: $ | Dividend Yield: %. Dividend history for stock CEQP (Crestwood Equity Partners LP) including historic stock price, dividend growth rate predictions based on history, payout ratio. CEQP is defunct since November 3, Summary · All · Analysis · Comments · News Top Quant Dividend Stocks · High Dividend Yield Stocks · Top Dividend.

Dividend yield history for Crestwood Equity Partners (CEQP). Crestwood Equity Partners (stock symbol: CEQP) dividend yield (TTM) as of August 10, %. Crestwood Equity Partners LP dividend history is presented both in graphical/chart form, and as a kinomorsik.online dividend history data table along the right-hand. Values are based on monthly closes adjusted for splits and dividends from Alpha Vantage. Compare Returns for S&P and CEQP. S&P , CEQP. Start Date. Instrument Name Crestwood Equity Partners LP Instrument Symbol (CEQP-N). Instrument Exchange NYSE · Summary · Charts · Profile · Financials · Statistics · Dividends. CEQP Dividend Information. CEQP has a dividend yield of % and paid $ per share in the past year. The last ex-dividend date was Oct 20, Crestwood Equity Partners LP (NYSE:CEQP): Dividend Yield. , %. , %. , %. , %. , %. CEQP dividends history · Debt to. Energy Transfer LP PFD UNIT REP LP (kinomorsik.onlineI) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay. Explore Crestwood Equity Partners LP (CEQP) dividend history, dividend yield range, next CEQP dividend date, and Crestwood Equity Partners LP stock dividend. Crestwood Equity Partners LP - Unit (CEQP) Dividend History. Crestwood Equity Partners LP (merged with Inergy, L.P.) owns and operates a rapidly growing. Examine dividends, yield on cost history and payout ratio for CEQP. See dividend growth and complete overview. View today's Crestwood Equity Partners LP stock price and latest CEQP news and analysis. Create real-time notifications to follow any changes in the live. Dividend history for Crestwood Equity Partners (CEQP). Crestwood Equity Partners (stock symbol: CEQP) made a total of 89 dividend payments. The sum of all. Historical dividends, when charted graphically, can reveal the long-term variability and/or growth within the CEQP dividend history record. Also see the CEQP. Dividend Yield and Dividend History Highlights. If you're seeking price stability while collecting dividends, note that CEQP has less volatility in its. Dividends. %. Current Dividend Yield. 51%. Payout Ratio. Does CEQP pay a reliable dividends? See CEQP dividend history and benchmarks. Who do I contact if I lost my CEQP tax package or need a prior year CEQP tax package? CEQP's current annual dividend and dividend yield are $ (%). Table and Chart of CEQP Performance. See what a $1, investment in CEQP is worth today. Crestwood Equity Partners' (NYSE:kinomorsik.online) dividend yield is %. Dividend payments have decreased over the last 10 years and are covered by earnings with. Gain insightful analysis on Crestwood Equity Partners LP (CEQP) Dividend Yield. Discover the current Dividend Yield, historical values, and how it compares. CEQP (Crestwood Equity Partners LP) Dividend Payout Ratio as of today (May 31, ) is Dividend Payout Ratio explanation, calculation.

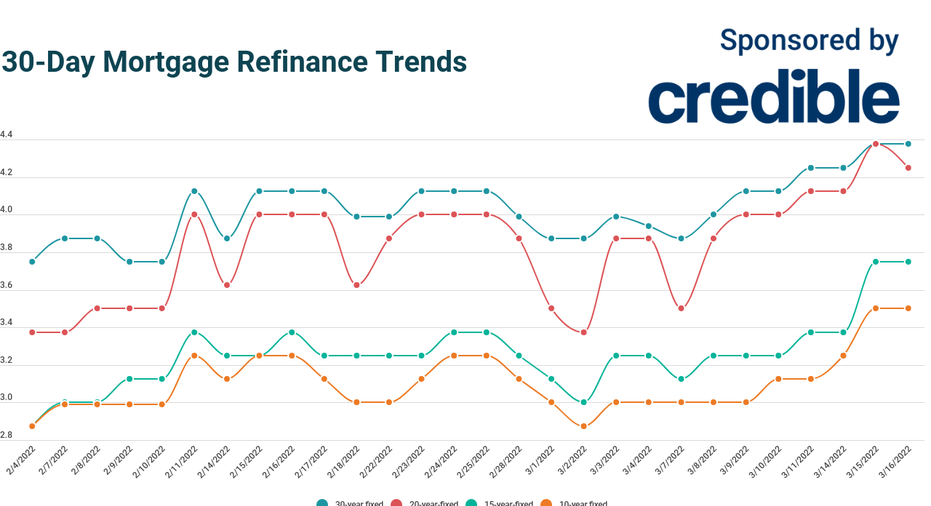

20 Year Fixed Refinance

yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate. %. APR. %. Points (cost). ($3,). See my rates. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. A year fixed mortgage means you have 20 years to pay off your loan. The longer the length of the loan, the less your monthly payment will be. New home purchase ; year fixed mortgage · % · % ; year fixed mortgage · % · %. 20 Year Fixed Rate, Resources: Calculate, Rate: %, APR*: %. 20 Year *The annual percentage rates (APR) displayed assume a loan amount of $, We call it 20/20 prepayment. Pay off up to 20% more of your mortgage each year through a combination of prepaying more of your original principal balance and. A year fixed-rate mortgage is a home loan that has a repayment period of 20 years. It has an interest rate that does not change throughout the life of the. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate. %. APR. %. Points (cost). ($3,). See my rates. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. A year fixed mortgage means you have 20 years to pay off your loan. The longer the length of the loan, the less your monthly payment will be. New home purchase ; year fixed mortgage · % · % ; year fixed mortgage · % · %. 20 Year Fixed Rate, Resources: Calculate, Rate: %, APR*: %. 20 Year *The annual percentage rates (APR) displayed assume a loan amount of $, We call it 20/20 prepayment. Pay off up to 20% more of your mortgage each year through a combination of prepaying more of your original principal balance and. A year fixed-rate mortgage is a home loan that has a repayment period of 20 years. It has an interest rate that does not change throughout the life of the. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet.

A year mortgage is even better than a regular year loan. Since it has a shorter term, it's considered less risky for most lenders. As of Aug. 30, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Year Fixed Refinance · Features & Benefits · Limited Time Offer · Calculators · Why Choose a Fixed-Rate · Let's Take a Look at Your Options: · Why Choose This · Why. Loans are backed by the Department of Veterans Affairs. Interest rate as low as. %. APR as low as. %. LTV up to. %. Term. to year. Learn. Compare year mortgage rates from lenders in your area. Get the latest information on current year fixed mortgage rates. Many borrowers will start out with a year fixed loan, but there are other Unlike other loans, though, this is generally 20% of the property's cost. Today's competitive rates† for fixed-rate refinance loans ; year · % · % ; year · % · % ; year · % · %. The following table shows current year mortgage refinancing rates available in Mountain View. You can use the menus to select other loan durations. 5 Year Fixed, %, %. 5 Year Variable, RBC Prime Rate - % ( These rates are available to customers with less than 20% down payment on a. Refinance your mortgage · Homeowner ReadiLine® · BMO Smart Fixed Mortgage · Switch 5 Year Smart Fixed. WHY PICK A FIXED RATE CLOSED MORTGAGE? A fixed rate. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Compare year fixed rates from multiple lenders to find the best year mortgage rate. Today's competitive rates† for fixed-rate refinance loans ; year · % · % ; year · % · % ; year · % · %. September refinance rates currently average % for year fixed loans and % for year fixed loans. year fixed rate refinance. %. %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Check year fixed refinance rates. Then personalize them. Your refinance rate depends on your credit score and other details. Not sure where to start? Check out our tools to get started · Payment Calculator · Affordability Calculator · Refinance Calculator · Penalty Calculator. While a year mortgage will result in a lower monthly payment, it will end up more costly cumulatively when compared to the year mortgage. This is because. In addition to the popular year fixed-rate first mortgage, Star One offers a year mortgage, year mortgage and year mortgage. Today's mortgage rates. As of August 30, , the best mortgage rates in Canada are: 5-year fixed at %, 3-year fixed at %, and 5-year variable at (e.g. down payment

Where To Put 401k Money Now

Money market funds are mutual funds that invest in short-term, low-risk assets like Treasury and government securities, commercial paper, or municipal debt—. Each employee participating in the plan determines how much money is to be automatically contributed from each paycheck. Generally, participants can invest an. We chose American Funds as the best target-date (k) investment option because of its strong quantitative research. More than 90% of the assets in the. put all of their savings into a money market or stable value fund. Sometimes Especially now that target date retirement funds (mutual funds that. First, since your reported salary is reduced by the amount put into your account, you'll pay fewer income taxes. Second, the money inside the account grows tax-. Now, throw as much money as you can into your k, invest it in a broad index fund or two, and don't look at it more than once a year for. We chose American Funds as the best target-date (k) investment option because of its strong quantitative research. More than 90% of the assets in the. If you can, find a handful of broad-market, low-cost, index funds for the two main asset classes: stocks and bonds. The key is to not get distracted by recent. Money put into a traditional IRA is generally tax-deductible, but you pay ordinary income tax rates on withdrawals. · Money put into a Roth IRA is not tax-. Money market funds are mutual funds that invest in short-term, low-risk assets like Treasury and government securities, commercial paper, or municipal debt—. Each employee participating in the plan determines how much money is to be automatically contributed from each paycheck. Generally, participants can invest an. We chose American Funds as the best target-date (k) investment option because of its strong quantitative research. More than 90% of the assets in the. put all of their savings into a money market or stable value fund. Sometimes Especially now that target date retirement funds (mutual funds that. First, since your reported salary is reduced by the amount put into your account, you'll pay fewer income taxes. Second, the money inside the account grows tax-. Now, throw as much money as you can into your k, invest it in a broad index fund or two, and don't look at it more than once a year for. We chose American Funds as the best target-date (k) investment option because of its strong quantitative research. More than 90% of the assets in the. If you can, find a handful of broad-market, low-cost, index funds for the two main asset classes: stocks and bonds. The key is to not get distracted by recent. Money put into a traditional IRA is generally tax-deductible, but you pay ordinary income tax rates on withdrawals. · Money put into a Roth IRA is not tax-.

Lower taxes: You get to invest money from your paycheck before taxes are taken out. The money isn't included in your taxable income amount, which lowers your. Keep 70% in the TD fund, 20% in the S&P fund, and 10% in EM. That will increase your risk profile, and keep more of your money with the. Lower taxes: You get to invest money from your paycheck before taxes are taken out. The money isn't included in your taxable income amount, which lowers your. Some k plans offer a linked brokerage account, where you can place some of your funds, and trade stocks, ETFs, and sometimes even options. · I. If you are closer to retirement, it's smart to shift your (k) allocations to more conservative assets like bonds and money market funds. 1. Set Your Goals. Enroll now to start saving for your future retirement. Consider increasing your contributions. Even small increases can make a difference. Increase. (k) rollover option 1: Keep your savings with your previous employer's plan · The amount of money in your account. If you have less than $5, in your former. Remember that a (k) is a retirement account, so you should plan not to withdraw money until you are at least 59 1/2. If you're fairly young now, that means. (k) InfoCenter (b) Regulations · The Voya Difference · Behavioral But it's been hard to connect those dots in the workplace — until now. Our. A plan sponsor is not required to include loan provisions in its plan. Profit-sharing, money purchase, (k), (b) and (b) plans may offer loans. Plans. You can even split your contributions between the two. REMINDER: YOU NEED TO CHOOSE YOUR INVESTMENTS. Remember that you will need to elect where your. (k) plans offer a similar feature. You can choose an annual withholding rate that will be automatically deducted from your salary each year and put towards. Let's keep your finances simple. Insure what you have. Invest when you're ready. Retire with confidence. Thinking of borrowing from your (k)? Here's what to consider before taking money out of your (k) plan accounts through either a loan or. The premise is that in retirement you'll likely be in a lower tax bracket than if you were taxed on the money now. 2. You are in control. You can contribute. Enroll now to start saving for your future retirement. Consider increasing your contributions. Even small increases can make a difference. Increase. Why not withdraw the funds and put some extra cash in your pocket right now? Because there are some major consequences of taking an early withdrawal from your. This type of plan, sometimes referred to as an Owner-only (k) plan, maximizes contributions because self-employed individuals can act as employer and. Depending on your circumstances, if you roll over your money from your old (k) to a new one, you'll be able to keep your retirement savings all in one place. All investing is subject to risk including the possible loss of the money you invest. *Vanguard is owned by its funds, which are owned by Vanguard's fund.

Stocks Under 10 That Pay Dividends

Below, Cabacungan offers more insights into the role that dividend-paying stocks could play in your portfolio. What exactly are dividends — and what kinds of. All stocks that have raised dividends for more than 25 years in a row. Dividend Stocks Year Dividend Increasing Stocks Year Dividend Increasing Stocks. 20 high-dividend stocks ; Franklin BSP Realty Trust Inc. (FBRT). % ; Seven Hills Realty Trust (SEVN). % ; AG Mortgage Investment Trust Inc (MITT). %. Cheap Dividend Stocks ; QQQY. Defiance Nasdaq Enhanced Options Income ETF. $ %, ETF ; Credit Suisse Group AG stock logo. CS. Credit Suisse Group. Quick Look at the Best Stocks With Dividends: · Pitney Bowes, Inc. · Chesapeake Granite Wash Trust · Banco Santander S.A. · AmBev S.A. Best Stocks Under $10 · Best Stocks Under $5 · Best Stocks Under $2 · Best Stocks Under $1 stock dividends to pay for your lifestyle. If you have a decade or. Quick Look at the Best Stocks With Dividends: ; PBI · Pitney Bowes. % ; CHKR · Chesapeake Granite Wash. % ; SAN · Banco Santander. % ; ABEV · Ambev. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. This research report focuses on all 78 individual. I'm looking to build my portfolio with focus on high dividends even high risk. Any ones come to mind would be greatly appreciated? Below, Cabacungan offers more insights into the role that dividend-paying stocks could play in your portfolio. What exactly are dividends — and what kinds of. All stocks that have raised dividends for more than 25 years in a row. Dividend Stocks Year Dividend Increasing Stocks Year Dividend Increasing Stocks. 20 high-dividend stocks ; Franklin BSP Realty Trust Inc. (FBRT). % ; Seven Hills Realty Trust (SEVN). % ; AG Mortgage Investment Trust Inc (MITT). %. Cheap Dividend Stocks ; QQQY. Defiance Nasdaq Enhanced Options Income ETF. $ %, ETF ; Credit Suisse Group AG stock logo. CS. Credit Suisse Group. Quick Look at the Best Stocks With Dividends: · Pitney Bowes, Inc. · Chesapeake Granite Wash Trust · Banco Santander S.A. · AmBev S.A. Best Stocks Under $10 · Best Stocks Under $5 · Best Stocks Under $2 · Best Stocks Under $1 stock dividends to pay for your lifestyle. If you have a decade or. Quick Look at the Best Stocks With Dividends: ; PBI · Pitney Bowes. % ; CHKR · Chesapeake Granite Wash. % ; SAN · Banco Santander. % ; ABEV · Ambev. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. This research report focuses on all 78 individual. I'm looking to build my portfolio with focus on high dividends even high risk. Any ones come to mind would be greatly appreciated?

Dividend Payment Schedule. Subject to declaration by the board of directors, dividends are paid on AEP common stock on or about the 10th day of March, June. Dividend-paying stocks provide a way for investors to get paid during rocky On January 10, , XYZ, Inc. declares a dividend payable to its. 53 Stocks ; SLG, SL Green Realty Corp. % ; EPR, EPR Properties, % ; APLE, Apple Hospitality REIT, Inc. % ; BBAR, Banco BBVA Argentina S.A., %. For example, if an individual owns 20 shares of stock in a company that pays $4 in dividends per year, then they receive $80 in dividend payments each year ( The top dividend-paying stocks for September include several Below, we look at the top 10 dividend stocks listed on either the New York. Penny stock with dividend paying ; 4. Saven Tech. ; 5. Ujjivan Small, ; 6. kinomorsik.online ; 7. D.K. Enterprises, 7 Best Cheap Dividend Stocks to Buy Under $10 · 15 Best Dividend Stocks to Buy 10 Highest-Paying Dividend Stocks in the S&P These large-cap. Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). How to Start Dividend Investing – Quick Guide. Find a high dividend-paying stock. You can screen for stocks that pay dividends on many financial sites, as well. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. Caterpillar (CAT), the world's largest maker of heavy construction and mining equipment, was added to the Dividend Aristocrats in January CAT has paid a. Percentage of S&P Stocks with Dividend Yields Greater than 10 There are no guarantees connected with the dividend payouts for dividend-paying stocks. The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. Year, Payment Date, Record Date, Amount. , , , $ , , $ , , $ , , Record, Payable, Amount, Type. 09/19/24, 10/10/24, $, Cash, quarterly. 06/20/24, 07/11/24, $, Cash, quarterly. 03/21/24, 04/11/24, $, Cash. Dividend-paying stocks could potentially pump up total returns from your stock portfolio and generate extra income. Key facts ; Index · Domestic Stock - General · Large Value · 11/10/ · A stock dividend is a payment to shareholders in the form of additional shares in the company. · Stock dividends are not taxed until the shares are sold by their. Dividend Payment Schedule. Subject to declaration by the board of directors, dividends are paid on AEP common stock on or about the 10th day of March, June. dividend paying stocks even yield more than 10% a year. However, not all StocksBest Penny Stocks to Buy NowBest Stocks Under $5Best Stocks Under $

Best Credit Card For Grocery Store Purchases

The Blue Cash Preferred® Card from American Express lets you earn 6% cash back on groceries at U.S. supermarkets, on up to $6, in purchases per year. That's. FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR GROCERIES · Blue Cash Preferred® Card from American Express · Blue Cash Everyday® Card from American Express. 8 best credit cards for groceries for September · + Show Summary · Blue Cash Preferred® Card from American Express · American Express® Gold Card. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. Earn cash back on everyday purchases, including grocery store and. At 6% cash back, the Blue Cash Preferred is the ultimate rewards card for U.S. supermarket shoppers. · The Capital One SavorOne has a lot of potential value for. The UOB Lady's Card and UOB Lady's Solitaire Card are the best options out of the lot, offering 6 mpd on groceries as long as you choose “Family” as your. Most of the top credit cards for grocery purchases fall under this umbrella, including the Blue Cash Preferred® Card from American Express, the American Express. One of the best features about the President's Choice Financial® Mastercard® is that it has no annual fee. Cardholders also get exclusive access to in-store. Chase Freedom Unlimited: This isn't a true flat-rate credit card (it earns 5% on travel purchased through Chase and 3% on dining and at drugstores), but its. The Blue Cash Preferred® Card from American Express lets you earn 6% cash back on groceries at U.S. supermarkets, on up to $6, in purchases per year. That's. FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR GROCERIES · Blue Cash Preferred® Card from American Express · Blue Cash Everyday® Card from American Express. 8 best credit cards for groceries for September · + Show Summary · Blue Cash Preferred® Card from American Express · American Express® Gold Card. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. Earn cash back on everyday purchases, including grocery store and. At 6% cash back, the Blue Cash Preferred is the ultimate rewards card for U.S. supermarket shoppers. · The Capital One SavorOne has a lot of potential value for. The UOB Lady's Card and UOB Lady's Solitaire Card are the best options out of the lot, offering 6 mpd on groceries as long as you choose “Family” as your. Most of the top credit cards for grocery purchases fall under this umbrella, including the Blue Cash Preferred® Card from American Express, the American Express. One of the best features about the President's Choice Financial® Mastercard® is that it has no annual fee. Cardholders also get exclusive access to in-store. Chase Freedom Unlimited: This isn't a true flat-rate credit card (it earns 5% on travel purchased through Chase and 3% on dining and at drugstores), but its.

You get 2% cash back on gas and grocery purchases and earn % cash back on all other purchases. Earn up to $ in statement credits in your first ten months. Top Grocery Shopping Credit Cards of · Capital One Quicksilver Cash Rewards Credit Card · Wells Fargo Active Cash Card · Bank of America Travel Rewards credit. 8 best credit cards for groceries for September · + Show Summary · Blue Cash Preferred® Card from American Express · American Express® Gold Card. Why is this one of the best grocery credit cards: The DoorDash Rewards Mastercard offers cardholders 4% cash back on grocery orders fulfilled through DoorDash. Why is this one of the best grocery credit cards: The DoorDash Rewards Mastercard offers cardholders 4% cash back on grocery orders fulfilled through DoorDash. Chase Freedom Unlimited: This isn't a true flat-rate credit card (it earns 5% on travel purchased through Chase and 3% on dining and at drugstores), but its. Best Credit Cards for Groceries in · Winner. Blue Cash Preferred Card from American Express · Best for 5% cash back. Citi Custom Cash Card · Best Chase card. Best Credit Cards with Grocery Rewards from Our Partners · Discover it® Cash Back · Citi Rewards+ Card · Citi Strata Premier℠ Card · Discover it® Miles · Wells Fargo. credit card with a high multiplier for grocery store purchases. Maxi only accepts Visa and Mastercard cards. So, the best credit cards to use at Maxi are. The Blue Cash Preferred® Card from American Express is the best everyday card for grocery store purchases, bar none. It also offers bonus cash back on gas. Top credit cards for grocery purchases · Blue Cash Preferred® Card from American Express · American Express® Gold Card · Capital One® Savor® Cash Rewards Credit. Top 3 Cards for Grocery Stores ; Chase Freedom Unlimited. 5X | ¢ Per Dollar Spent. Excludes Target and Walmart ; American Express Blue Preferred. 6X | ¢ Per. Many credit cards offer rewards or cash back for purchases made at grocery stores When it comes to choosing the best credit card for food purchases. Lowe's Advantage Card · 5% off all purchases automatically applies · Option for financing of six, 12, 18, or 24 months · Big project financing for up to 84 months. cash back on dining, entertainment, popular streaming services and at grocery stores. 1. Earn 1%. cash back on every purchase. The Simply Cash Preferred is one of the best cashback credit cards in Canada. The base cashback rate of 2% is great for all purchases, but the 4% on groceries. Intro APR (Purchases), Intro APR (Balance Transfer), Regular APR ; 0% on purchases for 12 months. 0% on balance transfers for 12 months. % - % Variable. AAA Daily Advantage Visa would be my recommendation. It earns 5% at grocery stores as well as 3% at wholesale clubs and pharmacies, so should cover all your. Today, find out why the American Express Cobalt Card is the best grocery store credit card to earn flexible rewards for your needs! Earn 1X point for every $1. Best credit card for groceries at U.S. supermarkets: Blue Cash Preferred® Card from American Express; Best grocery credit card for everyday use: Amex.